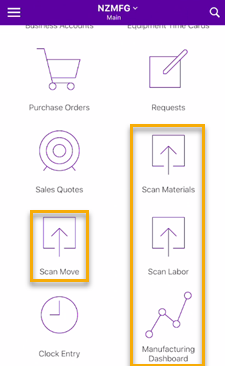

Shop Floor Data Collection for Manufacturing

Shop Floor Data Collection for Manufacturing is a new feature available to users with MYOB Advanced 2020.3 or higher. Shop floor data collection enables processing of manufacturing activities by users in the factory, using either the mobile app or a tablet. Users can access the following options – scan move, scan materials, scan labour and manufacturing dashboards.

Corporate Cards

The use of corporate credit cards are now supported on MYOB Advanced, enabling employees to categorize and track expenses. The feature can be utilized in field enabling employees to pay with a corporate card and charge it to a particular project. Key functionality advantages include:

- Administrative users can manage corporate cards

- Expense receipt and claims can be paid with corporate cards on the MYOB Advanced website and mobile app

- Supports foreign currencies

- Single expense claim can be created for all corporate card expenses

- Bank transaction matching and reconciliation process support corporate card statements so that card statement records can be matched to expense receipts

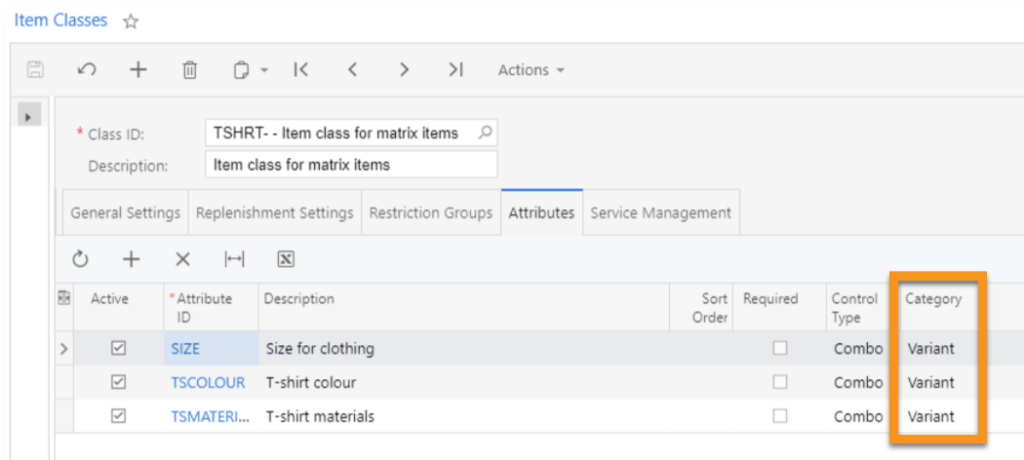

Matrix Stock Items

Suitable to businesses that have variations of high-level items and multiple attributes such as material, colour and size for clothing. With matrix items, user can create a wide variety of stock or non-stock items. It gives users the ability to print invoices or memos, sales orders and purchase orders that contain matrix items.

Prepayment Enhancement

Deposits on purchase orders within the prepayment functionality has been significantly enhanced. Users can add purchase orders directly to prepayment documents on the Cheques and Payments screen. Users can also create multiple prepayment requirements for a purchase order and subsequent prepayment requests can be created even if the previous one has not been released.

Budget Control on Document Entry

In the new release of MYOB Advanced 2020.3, the system automatically checks if a purchase order fits in the project budget. To do this the system looks at whether an entered document is within the cost budget of the project, taking into consideration the amount of budget that has already been used.

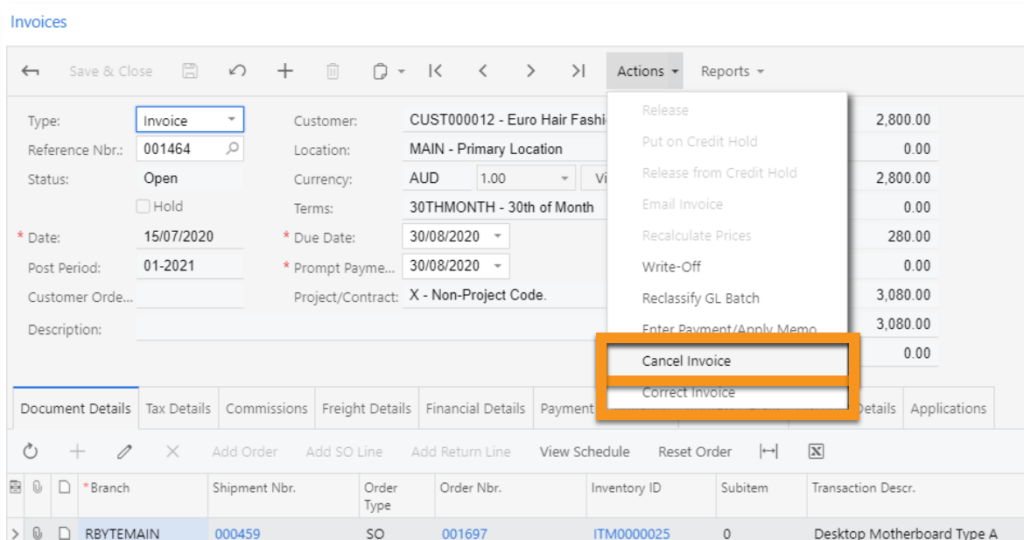

Correcting Sales Order Invoices

Previous versions of MYOB Advanced had no ability to edit or cancel sales order invoices that have already been released. This release introduces new actions which allow invoices to be cancelled. A correct invoice action has also been added to the invoice screen to correct existing invoices with an ‘open’ or ‘closed’ status as shown above.

Two Tier Change Management

The 2020 release introduces the Change Request feature which are detailed breakdowns of potential changes to the project budget and commitments. Ultimately, this feature gives organisations the ability to set up two-tier change management for the management of change orders.

Taxable Payment Reporting (TPAR)

The MYOB Advanced 2020.4 release introduces a feature that allow organisations to track taxable payments and report them on the Taxable payment annual report. This feature is for Australian businesses commonly in the building and construction industries who make payments to contractors or subcontractors and are required to report these payments to the ATO.