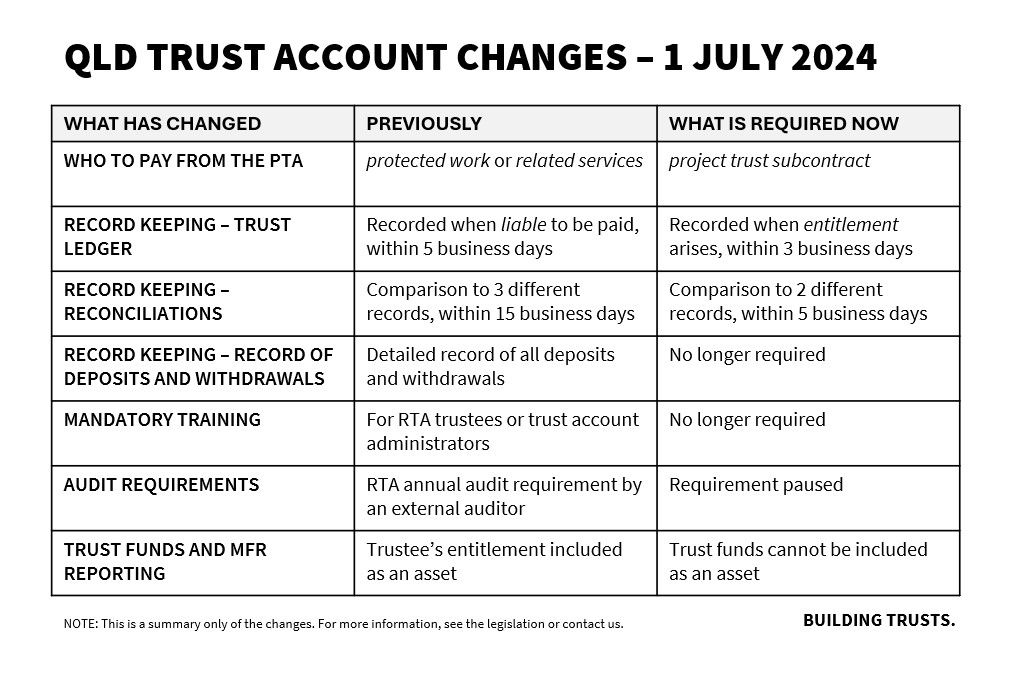

As of 1 July 2024, there have been various changes to simplify, clarify, pause or remove requirements to the QBCC Trust Account Framework. These adjustments aim to reduce the complexity and cost of compliance.

What has changed?

1. Payment from the PTA: Simplified to remove confusion around suppliers who also install or provide prefabricated components.

2. Record Keeping: Simplified to eliminate the need for a record of deposits and withdrawals, clarify when to record information on the trust ledger (when a beneficial interest arises), and how to conduct a reconciliation.

3. Training and Audits: The requirement for an annual retention trust audit has been paused, and mandatory retention trust training is no longer necessary.

4. Trust Funds for MFR Reporting: Clarified that trust funds can no longer be counted as part of a licensee’s assets under the Minimum Financial Requirements.

Impact on Trustees

Trust Ledger Changes: Impact when you can withdraw funds as trustee. Reminder: You cannot withdraw funds that a beneficiary is entitled to. Entitlement arises upon receiving a payment claim, not on certification or approval of a claim or issuing a payment schedule. This is a significant change.

Paused Audit Requirements: Eliminates the cost and difficulty of organising an independent audit of an RTA. Trustees with an upcoming RTA audit requirement no longer need to organise it. Reminder: You may still be audited by the QBCC as part of their approved audit program.

Simplified Payments from the PTA: Easier to determine who to pay and reduces some administrative burden. Further guidance will be provided soon.

Net Tangible Assets (NTAs): Ensure sufficient NTAs are maintained for your licence requirement, since trust funds cannot be included as an asset.

Record Keeping and Training: Simplified requirements and removal of retention trust training will save time and effort in trust account administration. Stay updated and communicate with your software provider to understand what changes they are making to assist compliance.

Please note that this is a summary only of the changes. Refer to the legislation directly or contact:

Laura Hattin at the Building Trusts for advice:

E: laura@buildingtrusts.com.au

M: 0481 194 000

MYOB Acumatica Construction

The first business management platform in Australia designed to help you nail trust account compliance.

For construction businesses who need to meeting QBCC Trust Account framework compliance obligations, MYOB Acumatica Construction provides smart tools to support these requirements.

Built with industry consultants, MYOB Acumatica Construction simplifies complex compliance for project and retention trust accounts. The platform helps you manage multiple ledgers, supports risk identification, and simplifies reporting across multiple accounts and projects.